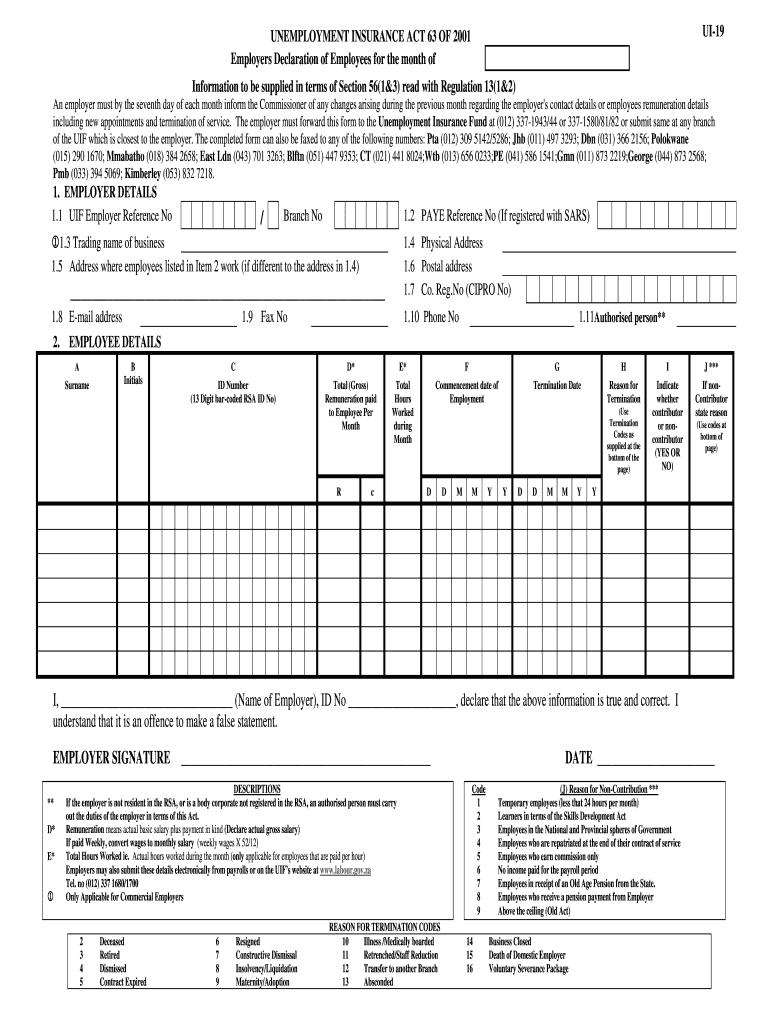

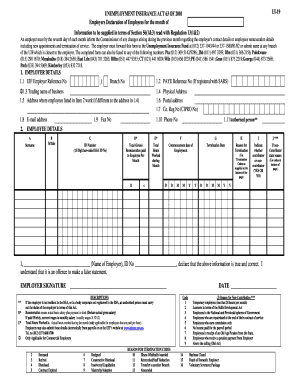

The employer must forward this form to the Unemployment Insurance Fund at (012) /44 or /81/ or submit same at any branch of the UIF which is closest to the employer The completed form can also be faxed to any of the following numbers Pta (012) 309 5142/5286;Copy of ID document;Agency Office of Workers' Compensation Programs Division of Federal Employees', Longshore and Harbor Workers' Compensation)

Notice For Upca Online Trial Registration 21 Upca

U 19 form download

U 19 form download-Department Of Labour Forms Ui 19 Department Of Labour Forms Ui 19, get all the detail of the Ui19 form and download using the link provide below These videos are step by step explanations on how to apply for UIF Your application's success will be guaranteed if you follow these steps to the letter Th

Icc U 19 World Cup Confident India Look To Carry On Momentum Against New Zealand Cricxtasy

A Rules as to Use of Form 1U (1) This Form shall be used for current reports pursuant to Rule 257(b)(4) of Regulation A (§§ ) (2) A report on this Form is required to be filed, as applicable, upon the occurrence of any one or more of the events specified in Items 1 – 9 of this Form ui19 forms MWentzel over 1 year ago Can VIP perhaps give an option on the UI19 form that we can print to allow us to print a UI19 form for somebody that is not discharged on the system in order for us to fill in end dates and reasons in ourselves pleaseThe Wage Listing Continuation form (UC0) for reporting additional employees Your completed (original) form should be mailed or faxed to the address or fax number shown below Questions about completing the Unemployment Tax and Wage Report may be directed to Arizona Department of Economic Security PO Box 527 • Mail Drop 51

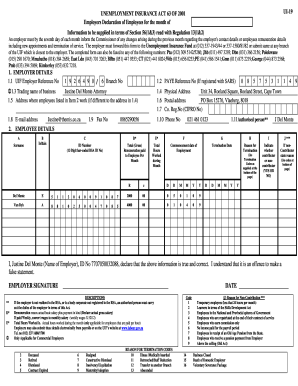

SignNow combines ease of use, affordability and security in one online tool, all without forcing extra software on you All you need is smooth internet connection and a device to work on Follow the stepbystep instructions below to eSign your example of completed ui 19 formUi 19 looking for a onesizefitsall solution to eSign ui19 form?The employer must forward this form to the UIF, PR ETORIA, 0052 or alternatively fax form to the above number 1 EMPLOYER DETAILS 11 UIF Employer Reference No 12 Name of Employer 13 Physical address 14 Postal address 15 Phone No 16 Fax No 17 Email address Microsoft Word UI 19 Section 56_3_ 3 March 03new

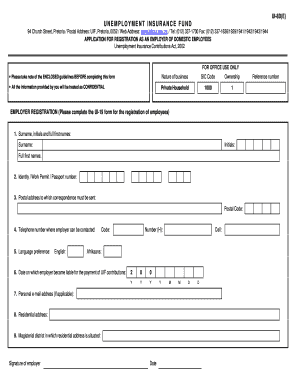

Form UI19 is the "declaration of information of commercial employees and workers employed in a private household" All employers must submit the form to the UIF before the 7 th of each month to update the Fund's database Declarations made by an employer in the UI19 Form must include Changes in the employer's contact details;This form must be completed when a bank extends credit in excess of $100,000 secured directly or indirectly, in whole or in part, by any margin stock FR U1 Page 2 of 2 Part II To be completed by bank only if the purpose of the credit is to purchase or carry margin securities (Part I (2) answered "yes") 1 List the margin stock securing thisThe following tips can help you complete Ui 19 Forms easily and quickly Open the document in the fullfledged online editing tool by clicking Get form Fill out the required fields which are marked in

19 Forms Fill Online Printable Fillable Blank Pdffiller

Euro U17 U19 Paredes 21 Media Accreditation Process Wseurope Rinkhockey

Form UI 19 Employers Declaration of Employees Description Form UI 19 Employers Declaration of Employees Information to be supplied in terms of Section 56(1&3) read with Regulation 13(1&2) Category LRA Forms Sub Category UIF Document Type Forms Filename Form UI 19 Employers Declarationpdf Publish Date Price FREE Author UIFIncluded with forms Current and historical Description Lenders that extend credit as permitted by the Board's margin requirements are sometimes required to fill out purpose statements to document the purpose of their loans secured by margin stock The FR T4 purpose statement is used for extensions of credit by brokers and dealers, the FR G3Dbn (031) 366 2156;

Apps Who Int Iris Bitstream Handle 3372 Who 19 Ncov Pregnancy Crf 4 Eng Pdf Sequence 1 Isallowed Y

Upca Registration Form 21 ci Under 16 19 Uttar Pradesh Cricket Association

17 (1) Application for unemployment benefits must be made in the prescribed form at an employment office (2) The application must be made within six months of the termination of the contract of employment, but the Commissioner may accept an application made after the six month time limit has expired on just cause shown The UI19 form along with the UI 8 D form can also be faxed to you Dial 086 712 00 and follow the instructions and the forms will be sent to you If you get UI19 form this way, you need to fax the completed forms back to 086 713 3000 Registering telephonically You can register by calling 012 337 1680 during office hours New Feature Individual UI 19 Forms Update 21 April The Department of Employment and Labour has opened a dedicated UIF toll free hotline, running 8am – 10pm Monday to Friday The number is 0800 030 007 In an effort to continue to simplify the world of payroll and employment, during this COVID19 crisis and beyond, we have added individual

/photo/2020/12/26/2858157699.jpg)

Indra Sjafri We Will Form The Indonesian U 19 National Team Born In 03 04 And 05 Netral News

.jpg)

In Stats Form History Make India Favourites To Win U 19 Wc Final

One portion of the UI28 Form must be completed by your bank and the other portion by you Email the completed UI28 Form and your contact details to VOsupport@labourgovza Step 5 Confirm or update your personal details, including physical and postal addresses and click on "Next" UI 19 and UI 27 (completed by employer) UI 21 (application form) UI 28 (bank form completed by bank) Letter from employer confirming reduced work time (or layoff) is due to the Coronavirus; Download Version Download File Size 2647 KB File Count 1 Create Date Last Updated UI19 form

U Form Bent Tube Showing Some Dimensions And The Location Of The Taken Download Scientific Diagram

19 Forms Fill Online Printable Fillable Blank Pdffiller

Title Microsoft Word UI19newdoc UI19newpdf Author marle Created Date 1/9/19 PMUI19 Employers Declaration of Employees for the month of The employer must forward this form to the Unemployment Insurance Fund at (012) /44 or /81/ or submit same at any branch of the UIF which is closest to the employerForm UIF Electronic Declaration Specifications Form UI6A Declaration to confirm unemployment status in terms of section 17 (4) read with regulation 3 (3) Form UI49 Application for issue of duplicate cheque Form UI8 – nsoek om registrasie as

19 Forms Fill Online Printable Fillable Blank Pdffiller

Flem Xl U Form Blue Home Butoraruhaz

The form should be mailed or handdelivered (cash) to the Gift Processing and Stewardship Services Office (GPSSO, see address below) Forward any unsigned checks, address changes, deceased notices, or replies without checks, etc to the GPSSO with a memo explaining the nature of the change or problemThis form is due on the last day of the second month after the end of the entity's tax year The due date for entities using a calendar tax year is Form OR19 Page 2 of 2, (Rev , ver 01) Oregon Department of Revenue141 Employers must complete the UI 19 Form stating the last date of termination and the reason thereof 142 The forms can be submitted through the following methods • Online at wwwufilingcoza (Illness benefits) • Email the application to the nearest UIF processing Centre (Illness/ Reduced Work Time/Death benefits)

In Form Delianov Chasing World Cup Berth Football News Afc U 19 Championship

Group B Matchday Three Preview Football News Afc U Asian Cup

UIF FORM U19 On termination of an employee's services a UI19 Form as prescribed by the Department of Labour must be handed to the employee It is important that the employee's last payslip be finalised before the UI19 form can be printed Then after termination, to print the UI19, follow the steps below 1 Click on the Main Screen onForm UI19 UIF Information of employee This form is to be completed by and submitted by an employer before the seventh day of each month to register/declare all employees and to inform the Commissioner of changes regarding the employer's contact details, and/or any changes to employee remuneration details during the previous month, thisGood day I sent through UI19 forms printed directly from Pastel Payroll when employees are terminated as it is very convenient However, received an email last week that a new UI19 form is available as from and the payroll one is wrong

Pcb Announces Schedule For Senior U 19 Cca Teams Trials

Ui19 Form Fill Out And Sign Printable Pdf Template Signnow

1 Liga U19 (Czech Republic) Form Table consists of 16 teams, generating its form stats from the last 6 matches that they have played The best performing team in the 1 Liga U19 is FC Viktoria Plzeň Under 19 The team with the worst form currently in the 1 Liga U19 is SFC Opava Under 19 View Football Form Guide for All Leagues To download the UI27 form generated by SimplePay Go to the employee's profile after ending their service Click on Manage End of Service Click on the PDF icon under Service Period History The first page of the PDF document will be your UI19 form and the second page is the UI27 formRefer to the above on how to apply 3 Reduced Work Time Benefit What happens if my employer reduces my working hours or places me on short time as a result of the COVID19 pandemic?

How To Claim Uif Part 3 Ui 19 Form Walkin Online Youtube

Icc U 19 World Cup New Zealand Challenge For India Sportstar

Below is a list of all the UIF forms that you might need in order to apply for UIF or to claim your UIF benefits Simply click the links to download Workseekers Form UI19 Declaration From Employers UI12 Appeal Form UI5 Application Continuation Adoption Benefits UI22 Application Illness Benefits UI23 Application Maternity Benefits UI24UIF Forms UI19 There is a general misconception in the industry that when you are registered at SARS for UIF, which every payroll client should be, you are automatically registered for UIF Not so, as the Unemployment Insurance Fund (UIF) does the payout for South Africans that are unemployed and SARS collects the funds on behalf of the UIF Form UC01 lists employees who have established claims based on work with you The information entered on the front of the form is obtained from the wage data you submitted quarterly If you did not file a quarterly report, either your Form UC19, Urgent Request for Wages, or the claimant's affidavit of earnings was used to determine the

U19 Eliitliiga Meistriliiga Form Table Estonia Footystats

.jpg)

In Stats Form History Make India Favourites To Win U 19 Wc Final

Step 1 Get the forms ** Get the UI8 and UI19 (for business employers) or the UI8D and UI19 (for domestic employers) from the website or at any labour centre Step 2 Fill in the forms ** Employers must complete the forms for both themselves and their workers ** The form for the registration of workers asks for an employer reference numberForm UI8 Application for registration as an employer (Businesses) Form UI19 Declaration of information of commercial employees and workers employed in a private household UI 12 Appeal to RAC Electronic versionGet the free 19 forms Get Form Show details Hide details UI19 UNEMPLOYMENT INSURANCE ACT 63 OF 01 Employers Declaration of Employees for the month of Information to be supplied in terms of Section 56 1 3 read with Regulation 13 1 2 An employer must by the seventh day of each month inform the Commissioner of any changes arising during the

Medical Forms Updated For Covid 19 British Sub Aqua Club

U 19 Irom Veen 25 64 Identical Drops Of Mercury Are Charged Simultaneously To The Same

NEIU 19 Covid Mitigation Attestment Form Click here to use the NEIU Request for Services form NEIU 19 Continuity of Education Hub Safe and Supportive Schools Toolkit Check out our "Miss you video" Coronavirus Information Click here for Press ReleaseForm UI8 Application for registration as an employer (Businesses) (161 KB) pdf (416 KB) document Form UI19 Declaration of information of commercial employees and workers employed in a private household (97 KB) pdf (441 KB) document The US Department of Labor (Department) is making an immediate call to action to all state administrators to ensure that UI integrity is a top priority and to develop state specific strategies to bring down the UI improper payment rate

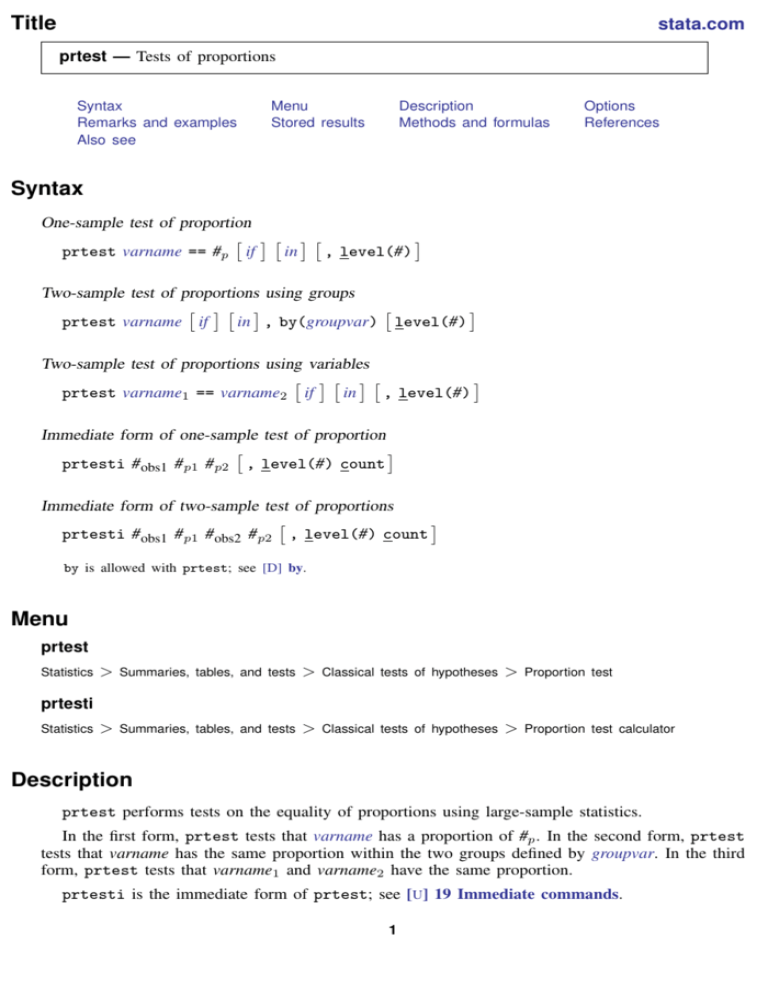

Prtest Stata

Pcb Update On U19 Open Trials At Provice Centres Local Players And Outstation Players To Attend Trials On 16 And 17 September Respectively Players Born On Or After 1 September

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How works Test new features Press Copyright Contact us CreatorsDE 1101ID Rev 5 (521) (INTERNET) Page 5 of 12 UNEMPLOYMENT INSURANCE APPLICATION Social Security number – – Please provide information about your very last employerThis is the employer you last worked for regardless of the length ofTraffic Violations Bureau Appeal Form Use to file an appeal from a conviction and/or penalty imposed for noncriminal moving violations after a DMV Traffic Violations Bureau hearing in New York City only (see Traffic Tickets ) For convictions or penalties by courts in other locations and courts, contact the court, not DMV, for appeal information

Aiff To Review India U 19 Team S Poor Form In Afc C Ships Qualifiers

Potsdam Germany 12th May 19 Soccer Dfb Club Cup Juniors U19 Final Rb Leipzig Vfb Stuttgart In Karl Liebknecht Stadion Lilian Egloff L Of Stuttgart Scores The Goal To 0 1 Credit Jan Kuppert Dpa

Jhb (011) 497 3293;C0 (Form Name Designation of a Recipient of the Federal Employees' Compensation Act Death Gratuity Payment under 5 USC § 8102a; A ui19 is a form used to declare to the uif your employees You fill it in and send it to the uif everytime an employee begins works, leaves work, or there is a salary change

1

12 May 19 Brandenburg Potsdam Soccer Dfb Club Cup Juniors U19 Final Rb Leipzig Vfb Stuttgart At Karl Liebknecht Stadion The Cup Is About To Be Played On A Podium At The Edge

Also see the "UIF Easy Guide for Electronic claims" (The UIF Easy Guide and the relevant forms are available at the link below)UI19 2 Description Code J (Reason for noncontribution*** Employer's stamp (if available) ** If the employer is not a resident in the RSA, or is a body corporate not registered in the RSA, an authorised person must carry out the duties of the employer in terms of this ActIf a company shuts down for a certain period or implements reduced work time/short time The benefit payable is the difference between the

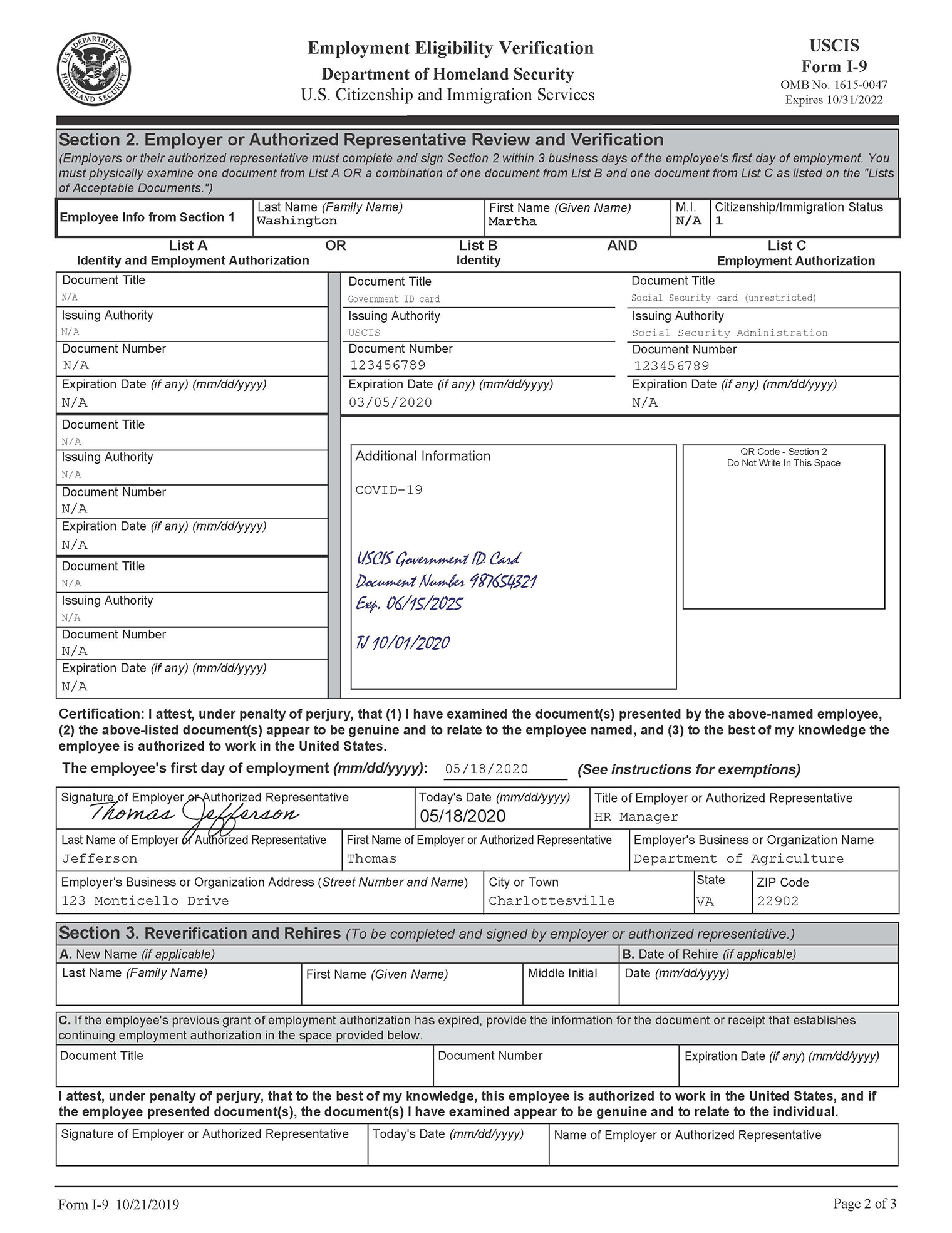

Form I 9 Examples Related To Temporary Covid 19 Policies Uscis

Reggio U Form Kanape

19A records are not complete DMV may require you to attend an administrative hearing You may be suspended and you may be required to pay civil penalties of $500 $2,500 per violation A repeat offender may be subject to civil penalties of up to $5,000 per violation 1 The corresponding Commissioner's Regulations for 19A can be found inU111 and U111a U111 and U111a – New York State Insurance Fund – Request for Inclusion of Additional Interest and includes U111a – Information on Entity for which Coverage is Requested This form must be completed for each entity, including the FEINs, signed and returned to NYSIF Please have the form signed by a principal or an executiveUI19 UNEMPLOYMENT INSURANCE Act 63 of 01 as amended Employer's Declaration of Employees for the month Information to be submitted in terms of Section 56 (1&3) read with Regulation 13 (1&2) The employer must forward this form to the Unemployment Insurance Fund at (012)/44 or /81/ or submit same at any branch of the UIF

Www Labourguide Co Za Workshop 1511 Unemployment Insurance Act Regulations Amendment

Download U19 Form

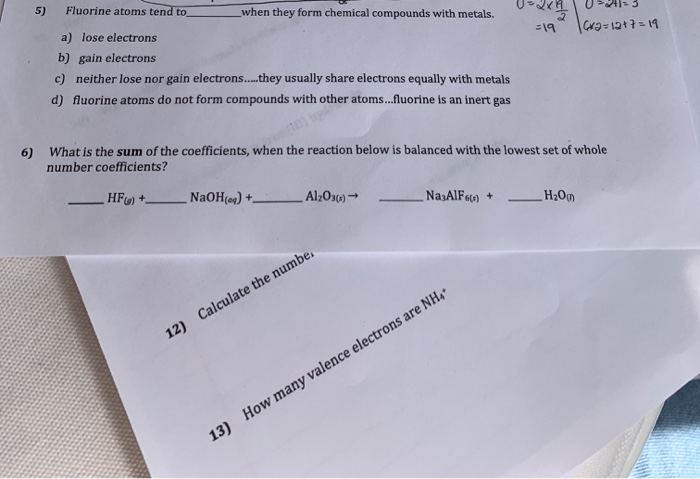

5 U 2x4u2413 19 Cra 12 7 19 Fluorine Atoms Tend To Chegg Com

Ghanaian Born Portuguese International Asumah Abubakar Continues Purple Patch Form Focalsports

What Is Ui19 Form

Competition Format Under 19 Uefa Com

Www Africlock Co Za Wp Content Uploads 13 09 Uif19 Form Pdf

Entry Form Information World Squash Federation

2

Pakistan Beat South Africa To Qualify For U 19 World Cup Semis

Prithvi Shaw Well And Truly Back Into Form News9 Live

Fillable Online Netball South Regional U19 League Player Registration Form Fax Email Print Pdffiller

Ag Neovo U 19 Specifications Pdf Download Manualslib

As Trencin U19 Facts And Data Transfermarkt

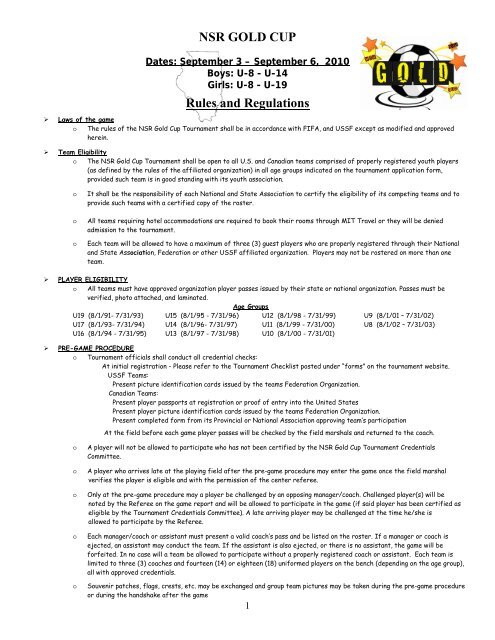

Iqfoil Youth U19 Junior U17 Class

1

U 19 World Cup Winning Member Samit Patel Retires From Indian Cricket Joins Cpl

Notice For Upca Online Trial Registration 21 Upca

Material Requirement Form Af U19 Vs Uae U19 Live Score

Sa U 19 World Cup Squad Taking Form Says Coach Shukri Conrad News Chant South Africa

Richter Czech Rk U Form Wc N Ajto Vasalat Alza Hu

Icc U19 World Cup Final Schedule India Vs West Indies Fixture Squads Timings Date Venue And Tv Listings Ibtimes India

Potsdam Germany 12th May 19 Soccer Dfb Club Cup Juniors U19 Final Rb Leipzig Vfb Stuttgart In The Karl Liebknecht Stadion Lilian Egloff L Of Stuttgart Cheers After Scoring The Goal To 0 1

.jpg)

In Stats Form History Make India Favourites To Win U 19 Wc Final

Uefa European Under 19 Championship Wikipedia

U19 Bundesliga Form Table Germany Footystats

Icc U 19 World Cup Confident India Look To Carry On Momentum Against New Zealand Cricxtasy

U 19 Wc In Form India Aim To Outclass Pakistan In Semis

kash S All Round Show Helps Jahnavi Degree College Win U 19 Title Hyderabad News Times Of India

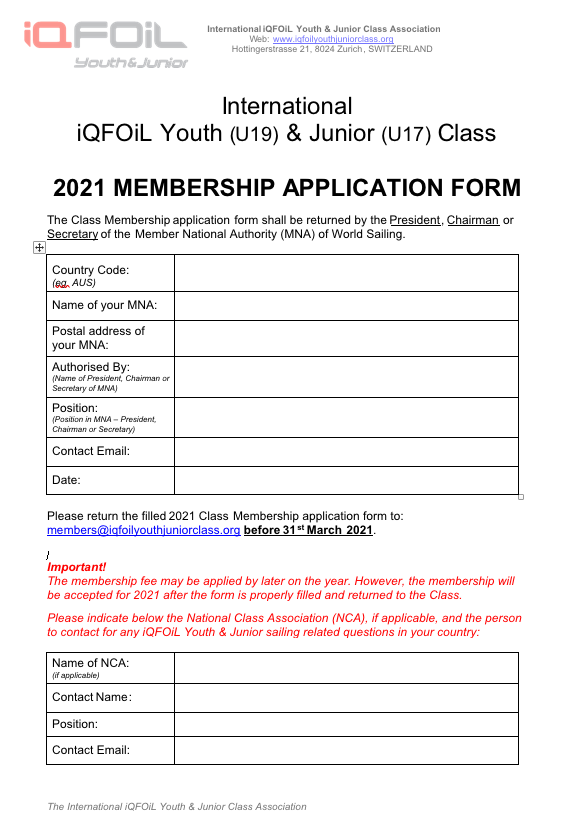

Nsr Gold Cup Rules And Regulations National Soccer Ranking

Uttar Pradesh S Priyam Garg To Lead India In U 19 World Cup Sports News

Under 19 World Cup As U 19 Selectors Take On Secretary A Bonus Goes Missing Cricket News Times Of India

Uif U19

2

Pssi Will Form New Generation U 19 National Team Netral News

Icc U 19 World Cup 18 Stats Preview From Australia S Dominance To India S Recent Form Numbers That Stand Out First Cricket News News Firstpost

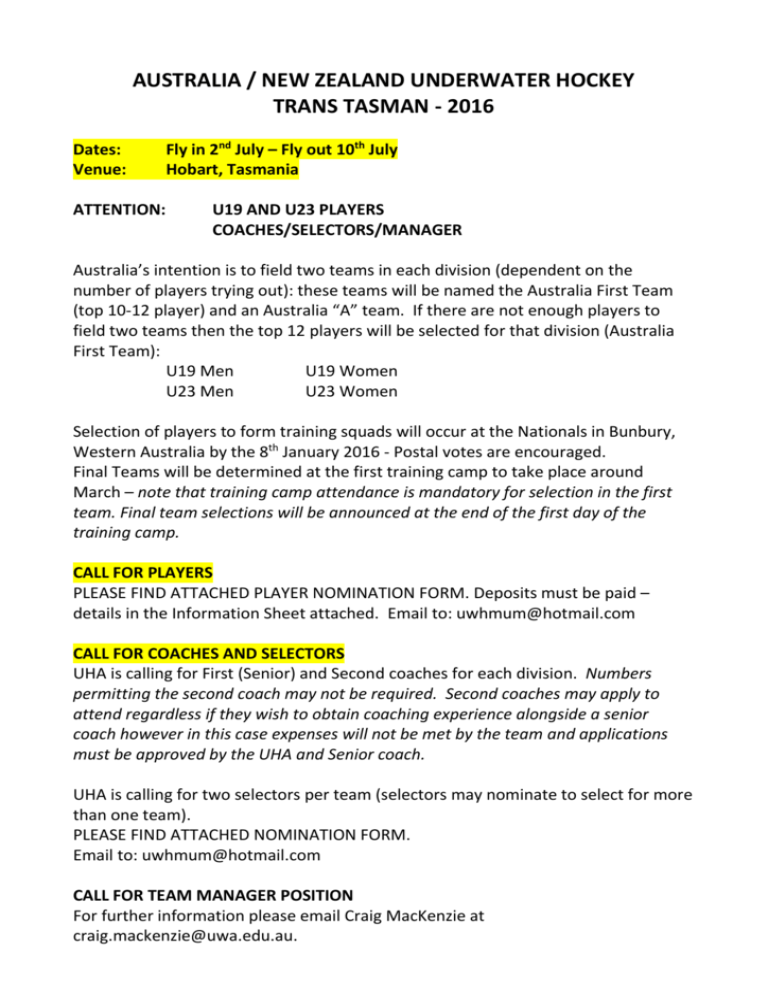

Trans Tasman Age Games Nomination Form

All Africa 21 U19 Airport Transfer Form Badminton Confederation Of Africa

Tahiti S Hine Taure A Are Ready To Make History Pasifika Sisters

2

.jpg)

In Stats Form History Make India Favourites To Win U 19 Wc Final

Www Africlock Co Za Wp Content Uploads 13 09 Uif19 Form Pdf

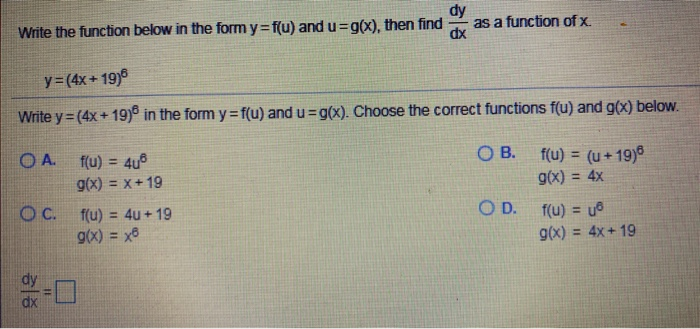

As A Function Of X Write The Function Below In The Chegg Com

1

2

Rk U Form Wc N Kilincs Kilincsek Postaladak Hu

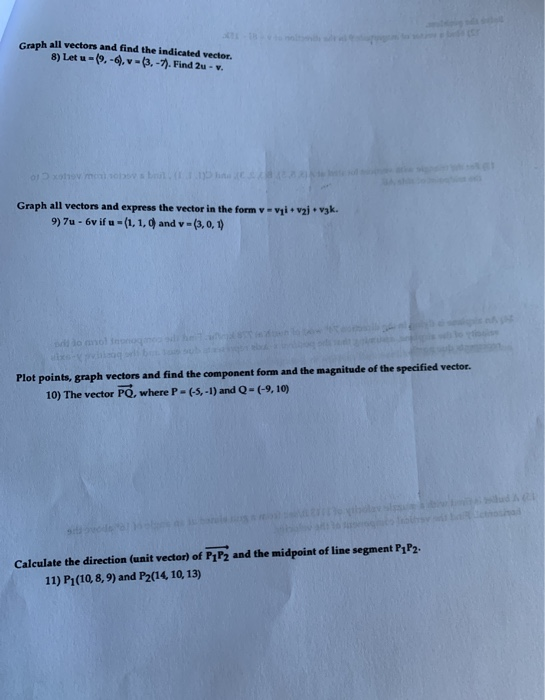

Graph All Vectors And Find The Indicated Vector 8 Chegg Com

Download Ui19 Form In Word Format Formfactory

Uzivatel Afghanistan Cricket Board Na Twitteru A Training Camp For 26 U19 Players Started In Kabul To Form And Prepare Afghanistan U19 Team For The Upcoming Competitions More T Co Zsnwzxskcx T Co Ct2luvnymw

Professional Solutions La Cie Solutions Concept Fastest Hardware

Important Information For Junior Age Group Cricketers Upca

Exposure That Zeng Fanbo Failed To Sign In The U19 Player Registration Form And Faces A Situation Where He Can Play Without The Ball Minews

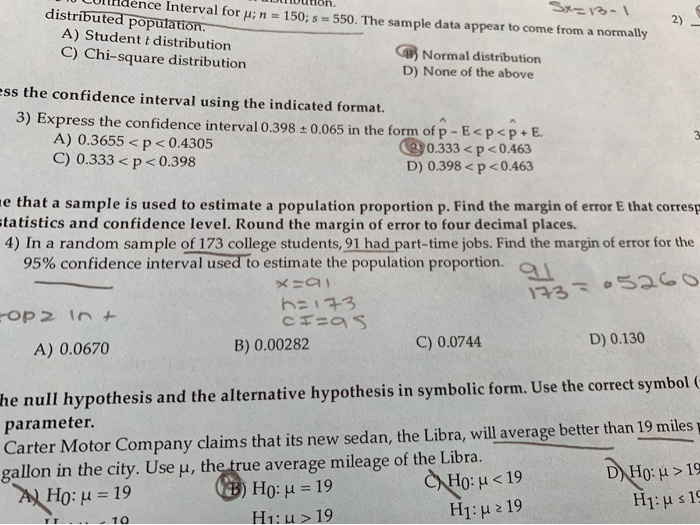

Solved Sxe13 Ence Interval For U N 150 S 550 The Sa Chegg Com

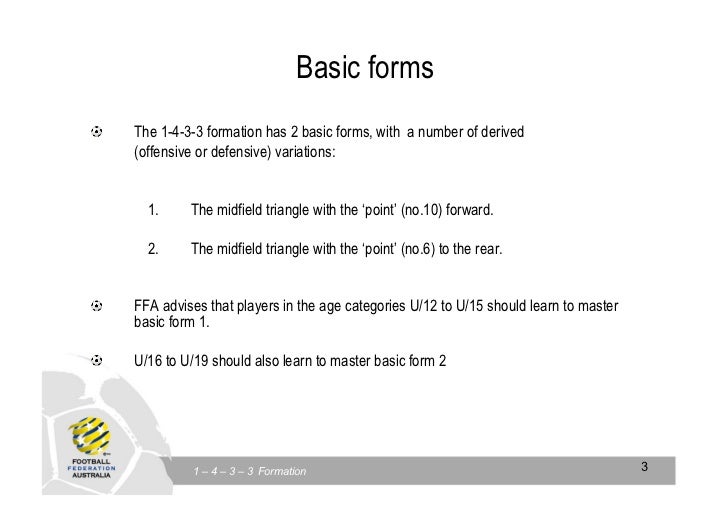

The 1 4 3 3 Formation

Surveon Nvr 2100 Series Spec In Guide Line

1 4 3 3 Formation Information

Design A Mascot For Uefa Under 19 Championship

18 If U 4i J U 31 7j Find W 2u U 19 Find The Chegg Com

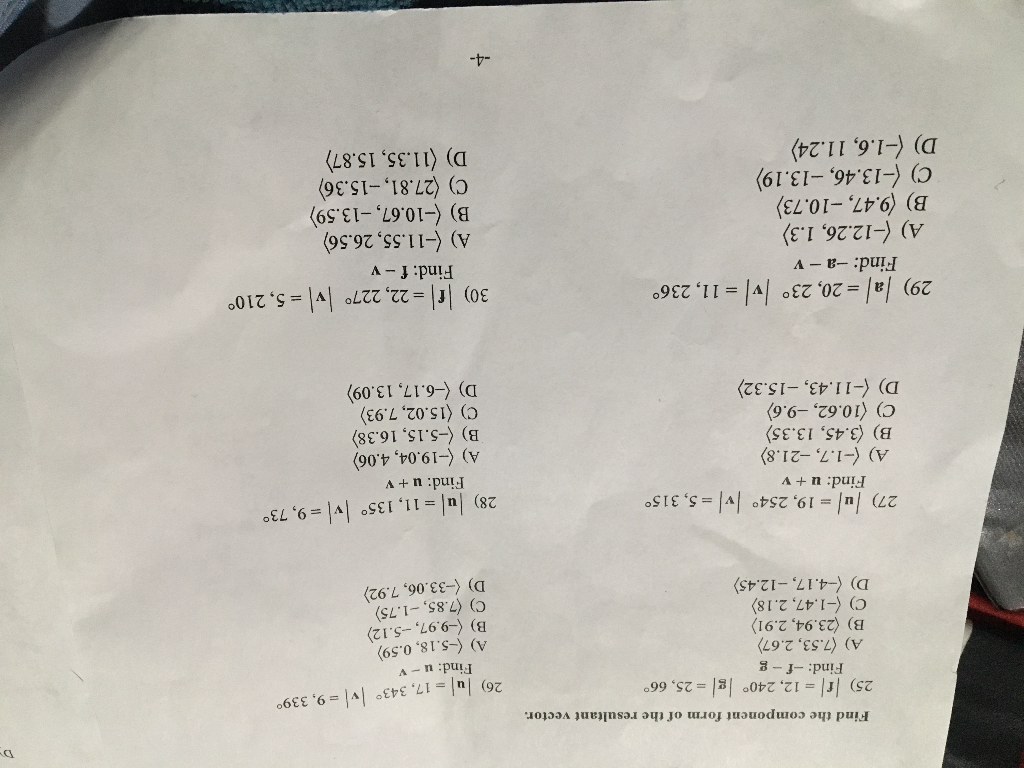

Find The Component Form Of The Resultant Vector 25 Chegg Com

Athletics Donegal 帖子 Facebook

The Elements That Make Up The Attribute Module The World Map Shows The Download Scientific Diagram

School Sports Check List Of U 19 Girls Sgfi Online Entry Form

U9 U11 U13 U15 U17 U19 Bronze Event Docsbay

U19 S Entry Form Now Available Isle Of Man Badminton Association

Prithvi Shaw Appointed Captain Of India S U 19 Squad For 18 Cricket World Cup Cricket News

B U D A P E S T 1 Budapest University Of Economic Sciences And Public Administration 2 Eotvos Lorand University Faculty Of Science Pdf Free Download

Icc U 19 Cricket World Cup India Firm Favourites Against Papua New Guinea Cricket Hindustan Times

India U19 Vs Pakistan U19 Ind Vs Pak U19 World Cup Dream11 Team Prediction Playing 11 Today Match Squad Players List Details Here

Veranstaltungs Dj Equipment 2 X 0 5 He U Form Rackblende Black Frontplatte Rackpanel Blende U 19 0 5he Co

Watch Icc U 19 World Cup Shubman Gill Continues His Bradmanesque Form With Help Of This Superstition

1

Looking To The Future Will Juve Give Youth A Chance Juvefc Com

2

U19 S Entry Form Now Available Isle Of Man Badminton Association

Exposure That Zeng Fanbo Failed To Sign In The U19 Player Registration Form And Faces A Situation Where He Can Play Without The Ball Minews

U 19 Team Aim To Carry England Form To Asia Cup 19 09 03

0 件のコメント:

コメントを投稿